Beyond Medicare: How CMSPricer’s Contract Manager Cuts Claims Processing Time by 3X and Guarantees Contract Accuracy

If you are already a user of our automated Medicare pricing and editing solution, you know the power of having accurate, up-to-the-minute CMS data at your fingertips. You’ve already eliminated the three-month pricing lag and reduced your reliance on manually verified fee schedules. But for Payers, PPOs, and large TPAs, the job doesn’t end with 100% Medicare rates. Your claims landscape is often a complex, shifting matrix of provider contracts, different fee-for-service (FFS) agreements, and varying reimbursement percentages.

Managing this complexity, ensuring that every claim is priced not just accurately, but specifically according to a provider’s unique contract, is a significant drain on your resources. It slows down processing, introduces manual error risk, and often requires teams to jump between systems or spreadsheets just to verify a single rate.

This is precisely why we developed the CMSPricer Contract Manager module: a fully integrated, cloud-based SaaS CMS repricing solution designed to bring the same level of speed and precision you expect from our core product to all your contracted claims. This tool is built to save you time and cost, accelerating your end to end claims configuration and processing up to three times faster than your current method.

Configuration: Making Claims At Any Specific Rate a Breeze

The core value of the Contract Manager is the total control it gives you over contract claims configuration. No more manual lookups. No more complex coding just to adjust a percentage.

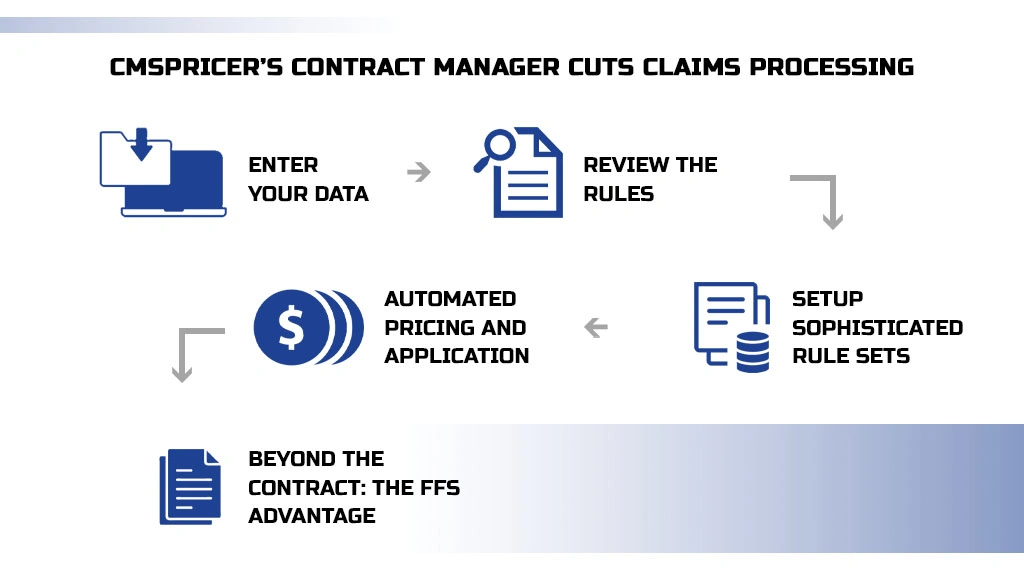

The process is designed to be intuitive and definitive:

Enter Your Data: You begin by simply loading your contract or Referenced Based Pricing (RBP) information and the associated specific rate details. This lays the foundation for automated pricing.

Review the Rules: After initial entry, you can immediately review the rules you loaded. The system provides clear transparency, showing you how different services will be treated based on your input.

Setup Sophisticated Rule Sets: This is where the real power lies. You can easily set up sophisticated, rule-based logic to handle exceptions and specific scenarios. Want to set a different reimbursement for a specific facility type, or limit a rate payment increase to a certain date range? The module allows you to configure these rules exactly to meet your requirements for different providers, facilities, or individual services.

Automated Pricing and Application: Once your rules are established, the system takes over. It automatically compiles claims groups by type (e.g., inpatient hospital, professional services) and then applies the contract parameters based on your specific requirements. This process leverages the core CMSPricer engine for accuracy while using your contract terms for the specific final rate.

Beyond the Contract: The FFS Advantage

Not every claim in a batch will fall under a Medicare or RBP contract. Providers in your network may change PPOs over time, or you may be dealing with simple fee-for-service claims.

The Contract Manager seamlessly integrates with the CMSPricer Fee-For-Service module. If a claim doesn’t match a contract rule, the system can automatically utilize multiple fee schedules to select the correct, current FFS or PPO rate. You maintain management control and significant cost-control leverage without manually sifting or rerouting the claims.

The bottom line for any Payer or TPA is efficiency married to accuracy. Our new Contract Manager eliminates the manual verification, accelerates your claims management, and generates reliable, exportable claim reports. All of this happens within our secure, cloud-based environment, no software to install, no complex contract to sign, and always 100% accurate, thanks to our robust, up-to-date data engine.

It’s time to stop manually policing contracts and let the Contract Manager module automate your entire claims pricing workflow.