How Automated Medicare Claims Repricing Can Improve Your Payer Efficiency

Medicare claims repricing can be a major pain point for many organizations, especially when handled manually. Payers, PPOs, TPAs, BPOs, Self-Funded Employers, and Auditing Firms often struggle with inefficient, outdated processes that lead to unnecessary errors, delays, and financial losses. The biggest challenge is the manual handling of Medicare pricing and contract management, which leaves room for critical mistakes and missed opportunities for accuracy. These outdated methods not only result in lower reimbursements but can also cause payers to continue reimbursing at outdated rates, leading to overpayments and operational inefficiencies.

Why Manual Medicare Repricing Doesn’t Cut It Anymore

As healthcare costs continue to rise and more claims are submitted, manual Medicare claims repricing simply isn’t feasible. Here’s what goes wrong when you rely on manual repricing methods:

Lower Reimbursements: When a payer continues to use old rates or methodologies, the result is lower reimbursements, which means healthcare providers aren’t receiving what they are actually owed for their services.

Overpayments: On the flip side, failing to account for updated contract terms or medical policies could cause payers to overpay. These overpayments can add up quickly, taking a toll on an organization’s financial health.

Time-Consuming Processing: Manually reviewing and updating claims is a labor-intensive process that drags out processing times, preventing timely reimbursements and wasting valuable resources.

Downstream Denials & Delayed Payments: As claims pass through the system, delays in processing and inaccurate repricing can lead to downstream denials or payment delays, further complicating your claims workflow.

Operational Inefficiency: The more time spent manually handling these issues, the less efficient your operations become, affecting overall performance and productivity.

How CMSPricer Transforms Your Medicare Claims Repricing Process

CMSPricer provides a solution to all these challenges by fully automating Medicare claims repricing and contract management. By implementing CMSPricer, Payers, PPOs, TPAs, BPOs, Self-Funded Employers, and Auditing Firms can streamline their processes, reduce errors, and speed up claim processing.

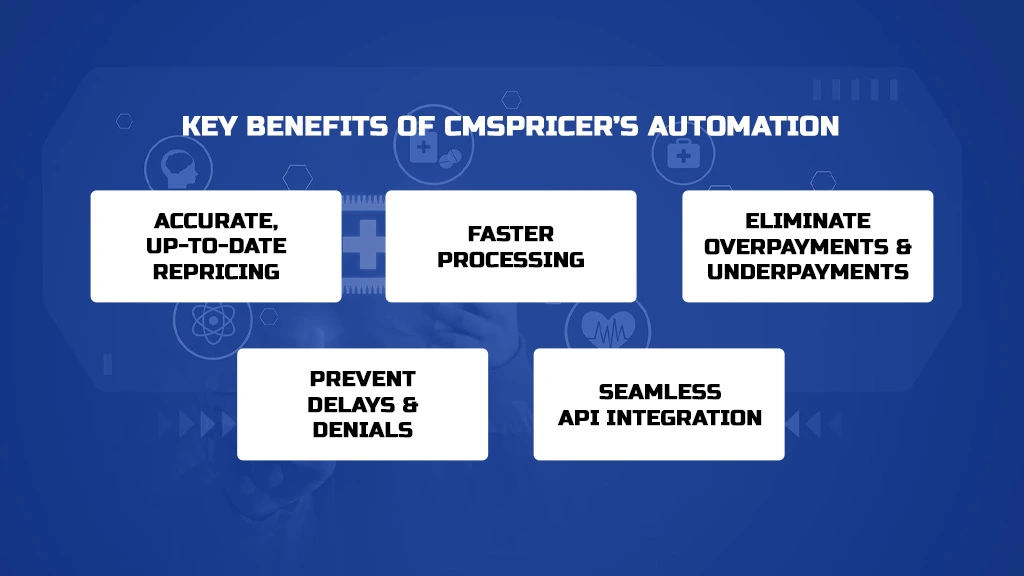

Key Benefits of CMSPricer’s Automation:

Accurate, Up-to-Date Repricing: CMSPricer ensures that every claim is priced according to the latest contract terms and policies, eliminating the risk of outdated rates and methodologies.

Faster Processing: With automated repricing, claims are processed faster, reducing bottlenecks in your workflow and ensuring providers receive their reimbursements on time.

Eliminate Overpayments and Underpayments: CMSPricer’s automation helps ensure that each claim is paid correctly, avoiding costly overpayments or underpayments that can eat into your profits.

Prevent Delays and Denials: Automation helps eliminate the manual errors that cause claims to be delayed or denied downstream, ensuring smoother operations and fewer rework requirements.

Seamless API Integration: CMSPricer’s solution is fully automated via API, which makes integration with your existing systems seamless, without disrupting your operations.

Why Automation is Essential for the Future

The reality is, manual processes are no longer sustainable in today’s fast-paced healthcare environment. For Payers, PPOs, TPAs, BPOs, Self-Funded Employers, and Auditing Firms, CMSPricer offers a robust, efficient solution that helps you automate Medicare claims repricing and contract management from start to finish.

By shifting to CMSPricer’s automated platform, you can ensure timely and accurate claim processing, reduced operational costs, and better financial outcomes. Plus, you’ll avoid the risk of overpaying or underpaying claims, which can lead to substantial losses down the road.

Start Automating with CMSPricer Today

Are you ready to improve your Medicare claims repricing process? With CMSPricer, you can finally say goodbye to manual errors and inefficiencies. It’s time to embrace automation and take control of your Medicare pricing and contract management. Whether you’re a payer, PPO, TPA, BPO, self-funded employer, or auditing firm, CMSPricer can streamline your operations and help you save both time and money.

Visit our FAQ page to learn more about how CMSPricer’s automated solution can transform your Medicare claims repricing and contract management process. Let us help you automate your workflow and drive better financial results today.