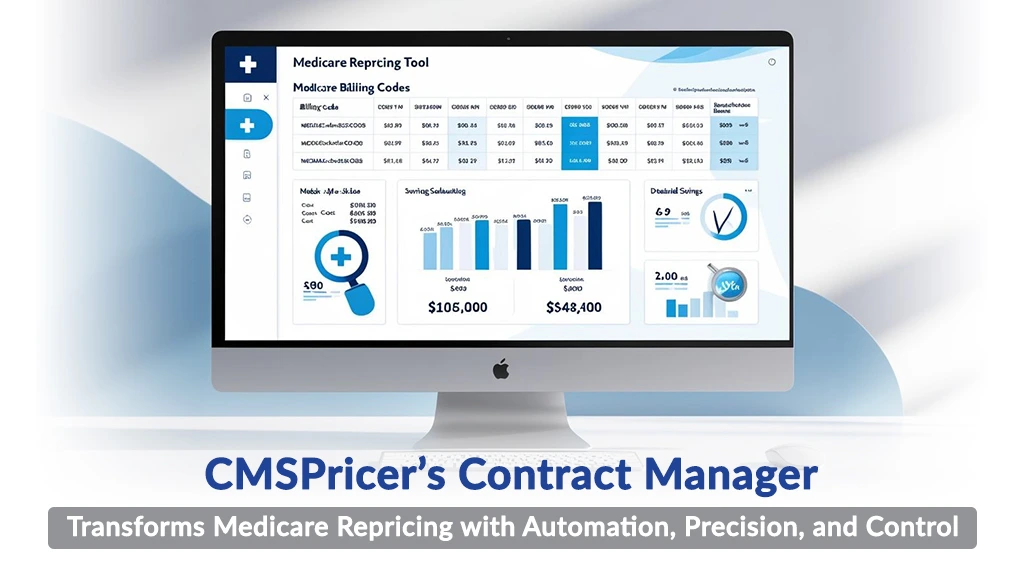

How CMSPricer’s Contract Manager Transforms Medicare Repricing with Automation, Precision, and Control

Navigating Medicare contracts can be a daunting challenge for payers, third-party administrators (TPAs), and self-funded employers. With shifting CMS pricing rules and evolving provider networks, manual processes often lead to costly errors and delays.

That’s where CMSPricer’s Contract Manager module comes in—a transformative SaaS-based solution that automates contract configuration, fee schedule management, and claims pricing. By ensuring accuracy and compliance at speed, it empowers organizations to take control of their Medicare contracts and turn complexity into opportunity.

The Hidden Cost of Manual Contract Management

The management of Medicare contracts relies on setting fee-for-service (FFS) rates, following CMS regulations, and adjusting to changing provider networks. Conventional methods, such as spreadsheets, outdated systems, or manual data entry, are prone to errors and inefficiencies. An incorrectly set rate or an obsolete fee schedule can lead to claim rejections, payment delays, or compliance issues. For third-party administrators (TPAs) handling numerous clients or payers managing extensive networks, these inefficiencies can rapidly accumulate, diminishing profit margins and placing a strain on resources.

CMSPricer’s Contract Manager eliminates these pain points by automating the entire contract lifecycle. From initial setup to real-time rate adjustments, the platform ensures claims are priced accurately the first time, slashing administrative overhead and accelerating revenue cycles.

5 Ways CMSPricer’s Contract Manager Simplifies Repricing

1. Effortless Contract Configuration

The module enables users to quickly upload contract terms, risk-based pricing (RBP) agreements, and fee schedules. It allows for configuring rates for individual providers, facilities, or entire networks, using an intuitive interface for teams.

- Define custom rule sets (e.g., rate increases effective on specific dates).

- Assign fee schedules to PPO networks or FFS arrangements.

- Automatically apply CMS pricing rules to avoid noncompliance.

This flexibility ensures contracts align perfectly with organizational or client-specific requirements.

2. Dynamic Fee Schedule Management

Provider networks evolve, and so do CMS regulations. Contract Manager eliminates manual updates by:

- Maintaining multiple fee schedules in one centralized hub.

- Automatically selecting the correct PPO or FFS rate based on the provider’s current network status.

- Applying annual rate increases or ad-hoc adjustments without disrupting workflows.

This agility ensures payers and TPAs always bill and reimburse claims at the most up-to-date rates.

3. Real-Time Claims Grouping & Pricing

The platform groups claims by type (e.g., inpatient, outpatient) and applies preconfigured rules to automate pricing. For example:

- Claims for a specific provider organization can be priced at a negotiated FFS rate.

- Services rendered outside a network trigger default CMS rates.

- Date-specific rules adjust pricing for contracts with tiered renewal terms.

By automating these steps, organizations process claims 3x faster while eliminating manual errors.

4. Seamless Integration with Existing Systems

Contract Manager integrates via API with EHRs, billing systems, and clearinghouses. This means:

- No disruptive software overhauls.

- Real-time data sync between contract terms and claim submissions.

- Automated report generation for auditing or client reviews.

5. Proactive Compliance Safeguards

The module embeds CMS pricing rules directly into contract configurations. This ensures claims adhere to:

- Medicare’s Correct Coding Initiative (CCI).

- Medically Unlikely Edits (MUE).

- State-specific Medicaid requirements.

By preempting compliance issues, payers reduce audit risks and avoid costly retroactive adjustments.

Tangible Outcomes for Payers and TPAs

Organizations using Contract Manager report measurable results:

- 70% Faster Contract Setup: Configure complex agreements in hours, not days.

- 99% Pricing Accuracy: Eliminate under/overpayments tied to manual errors.

- 3x Faster Claims Processing: Automate grouping, pricing, and reporting.

- Scalability: Manage thousands of contracts or providers without added staff.

For TPAs, this means delivering greater value to clients through transparency and efficiency. For self-funded employers, it translates to predictable costs and fewer billing disputes.

The Future of Medicare Contracting is Automated

In a sector with tight margins and strict compliance requirements, CMSPricer’s Contract Manager is a vital strategic tool. It automates repricing, manages fee schedules, and ensures compliance, helping organizations reduce administrative tasks, speed up cash flow, and prepare for future regulatory changes.

For payers and TPAs, the message is clear: Manual processes are a liability. Automation is the key to resilience.

Are you ready to revolutionize your contract management process?

CMSPricer’s Contract Manager simplifies your Medicare repricing processes. Learn more at cmspricer.com/contract-manager.