Saving Time & Cost of Medicare Repricing with a New Editing Feature

Managing Medicare claims is a significant challenge for TPAs and auditors due to evolving CMS regulations and coding complexities. CMSPricer provides an automated API solution that helps healthcare organizations validate claims before submission, reducing denials and boosting first-pass acceptance rates.

Why Do Medicare Claims Get Denied?

Medicare TPAs and auditors often face challenges with denied claims due to issues like incorrect coding, outdated coverage determinations, and missing or invalid modifiers. These errors delay payments and raise administrative costs from rework and resubmissions.

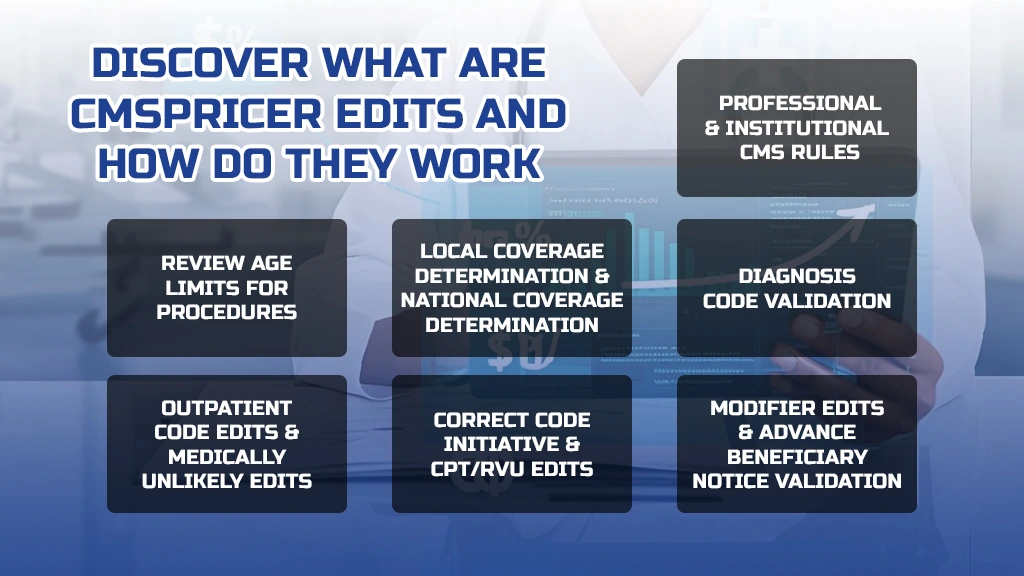

What Are CMSPricer Edits and How Do They Work?

CMSPricer edits encompass multiple validation layers to ensure claims are accurate before submission. These edits include:

- Professional and Institutional CMS Rules – Make sure to follow Medicare billing guidelines.

- Diagnosis Code Validation – Check diagnosis codes to ensure they match CMS rules.

- Local Coverage Determination (LCD) & National Coverage Determination (NCD) – Verify that services meet Medicare coverage requirements.

- Age Edits – Review age limits for procedures.

- Outpatient Code Edits (IOCE) & Medically Unlikely Edits (MUE) – Identify any incorrect combinations of procedures.

- Correct Code Initiative (NCCI) & CPT/RVU Edits – Ensure codes are bundled correctly and that relative value units are accurate.

- Modifier Edits & Advance Beneficiary Notice (ABN) Validation – Confirm that modifiers are used correctly and that patient liability notices are accurate.

How Does CMSPricer Benefit Medicare TPAs and Auditors?

Implementing CMSPricer’s automated editing solution offers several key advantages. These benefits streamline workflows, enhance efficiency, and improve overall accuracy in content management processes.

- Reducing Denials and Rebilling Workflows – Avoids unnecessary rework due to incorrect coding.

- Minimizing Days in A/R – Faster claim acceptance leads to quicker reimbursements.

- Ensuring Correct Coding Compliance – Helps meet regulatory and payer requirements.

- Identifying Medical Necessity Issues Pre-Submission – Reduces claim rejection rates.

- Providing Real-Time Error Notifications – Instant alerts on claim errors allow for immediate corrections.

What Are the Results of Using CMSPricer Edits?

CMSPricer offers an automated editing solution that provides quantifiable outcomes, including:

- Reduction in Claim Denials – Ensures a first-pass submission rate of over 98%.

- Identification of Missed Revenue Opportunities – Prevents revenue loss due to coding errors.

- Faster Revenue Cycle – Reduces rework time and expedites payment processing.

- Lower Administrative Costs – Saves an average of $10–$25 per rejected professional claim.

- Automatic CMS Rule Updates – Eliminates the need to track regulatory changes manually.

How Easy Is It to Implement CMSPricer?

CMSPricer offers an editing solution tailored for seamless integration into existing systems. Users can easily configure edits to be activated or deactivated, and the system will automatically validate claims accordingly. Additionally, many clients leverage the API for real-time data exchange, facilitating smooth workflow automation.

Final Thoughts

For Medicare third-party administrators (TPAs) and auditors aiming to enhance claims processing efficiency, CMSPricer’s automated editing solution stands out as a valuable resource. This tool helps in reducing errors, thereby lowering claim denials and expediting reimbursements. By implementing such technology, organizations can not only save both time and money but also significantly improve their overall operational efficiency.

For more details, visit CMSPricer.